Ocity II

Invest in Luxembourg real estate with OCITY II

Fonds ouvert à la souscription

Please fill in this mandatory field.

Please fill in this mandatory field.

Veuillez renseigner un numéro de téléphone valide.

Please fill in this mandatory field.

Veuillez renseigner une adresse email valide.

Please fill in this mandatory field.

Please fill in this mandatory field.

Please fill in this mandatory field.

Please fill in this mandatory field.

Please fill in this mandatory field.

À toutes fins utiles, il vous est rappelé que MIMCO Asset Management est une filiale du groupe MIMCO Capital et qu’elles sont deux entités différentes. La société MIMCO Capital est une société de droit luxembourgeois non régulée qui propose les solutions d’investissement Mercureim EF1, Everest One, BUILDIM 19 et OCITY. Ses fonds sont réservés exclusivement aux investisseurs professionnels au sens de la directive 2014/65/UE - MiFID II. MIMCO Asset Management est née du développement de MIMCO Capital vers la France. MIMCO Asset Management est une société de gestion de droit français régulée par l’AMF sous l’agrément n° GP-21000018, qui gère les fonds MIMCO Grand-Ducal, MIMCO Revitalize et MIMCO Green Value. Par renvoi de l'article L. 214-144 du CMF, ses fonds en cours et à venir sont exclusivement réservés aux investisseurs professionnels et assimilés professionnels en France, répondant aux conditions de l’article 423-27-1 du Règlement général de l’AMF, à savoir ceux susceptibles d’investir au minimum 100.000 EUR. Il est de votre seule responsabilité de connaître et de respecter toutes les législations et réglementations applicables dans la juridiction qui vous concerne en relation avec votre accès à ce site internet. Si vous n'êtes pas certain de pouvoir être considéré comme un investisseur professionnel au regard des lois et règlements en vigueur, vous devriez solliciter le conseil d’un expert indépendant. L’ensemble des contenus de ce site web est fourni uniquement à des fins d’information et ne constitue nullement une offre ou une recommandation d’achat ou de vente de produits ou services financiers quelconques, ni une promesse d’entreprendre ou de solliciter une activité, et ne saurait être considéré comme fiable en relation avec une offre ou une vente quelconque de produits ou services financiers. Les informations figurant sur ce site sont protégées par le droit d’auteur et tous les droits sont réservés. Elles ne peuvent être ni reproduites, ni copiées, ni redistribuées en totalité ou en partie. En cliquant sur « Continuer », vous confirmez à MIMCO Asset Management que vous accédez à ce site en qualité d'investisseur professionnel disposant des connaissances et des compétences nécessaires pour évaluer les risques associés aux investissements dans des produits financiers, de même, vous confirmez que votre utilisation de ce site ne viole aucune loi ou réglementation applicable.

À toutes fins utiles, il vous est rappelé que MIMCO Platform est une filiale du groupe MIMCO Capital et qu’elles sont deux entités différentes. La société MIMCO Capital est une société de droit luxembourgeois non régulée qui propose les solutions d’investissement Mercureim EF1, Everest One, BUILDIM 19 et OCITY. Ses fonds sont réservés exclusivement aux investisseurs professionnels au sens de la directive 2014/65/UE - MiFID II. MIMCO Platform est née du développement de MIMCO Capital vers la France. MIMCO Platform est une société de gestion de droit français régulée par l’AMF sous l’agrément n° GP-21000018, qui gère les fonds MIMCO Grand-Ducal, MIMCO Revitalize et MIMCO Green Value. Par renvoi de l'article L. 214-144 du CMF, ses fonds en cours et à venir sont exclusivement réservés aux investisseurs professionnels et assimilés professionnels en France, répondant aux conditions de l’article 423-27-1 du Règlement général de l’AMF, à savoir ceux susceptibles d’investir au minimum 100.000 EUR. Il est de votre seule responsabilité de connaître et de respecter toutes les législations et réglementations applicables dans la juridiction qui vous concerne en relation avec votre accès à ce site internet. Si vous n'êtes pas certain de pouvoir être considéré comme un investisseur professionnel au regard des lois et règlements en vigueur, vous devriez solliciter le conseil d’un expert indépendant. L’ensemble des contenus de ce site web est fourni uniquement à des fins d’information et ne constitue nullement une offre ou une recommandation d’achat ou de vente de produits ou services financiers quelconques, ni une promesse d’entreprendre ou de solliciter une activité, et ne saurait être considéré comme fiable en relation avec une offre ou une vente quelconque de produits ou services financiers. Les informations figurant sur ce site sont protégées par le droit d’auteur et tous les droits sont réservés. Elles ne peuvent être ni reproduites, ni copiées, ni redistribuées en totalité ou en partie. En cliquant sur « Continuer », vous confirmez à MIMCO Platform que vous accédez à ce site en qualité d'investisseur professionnel disposant des connaissances et des compétences nécessaires pour évaluer les risques associés aux investissements dans des produits financiers, de même, vous confirmez que votre utilisation de ce site ne viole aucune loi ou réglementation applicable.

À toutes fins utiles, il vous est rappelé que MIMCO Capital est une filiale du groupe MIMCO Capital et qu’elles sont deux entités différentes. La société MIMCO Capital est une société de droit luxembourgeois non régulée qui propose les solutions d’investissement Mercureim EF1, Everest One, BUILDIM 19 et OCITY. Ses fonds sont réservés exclusivement aux investisseurs professionnels au sens de la directive 2014/65/UE - MiFID II. MIMCO Capital est née du développement de MIMCO Capital vers la France. MIMCO Capital est une société de gestion de droit français régulée par l’AMF sous l’agrément n° GP-21000018, qui gère les fonds MIMCO Grand-Ducal, MIMCO Revitalize et MIMCO Green Value. Par renvoi de l'article L. 214-144 du CMF, ses fonds en cours et à venir sont exclusivement réservés aux investisseurs professionnels et assimilés professionnels en France, répondant aux conditions de l’article 423-27-1 du Règlement général de l’AMF, à savoir ceux susceptibles d’investir au minimum 100.000 EUR. Il est de votre seule responsabilité de connaître et de respecter toutes les législations et réglementations applicables dans la juridiction qui vous concerne en relation avec votre accès à ce site internet. Si vous n'êtes pas certain de pouvoir être considéré comme un investisseur professionnel au regard des lois et règlements en vigueur, vous devriez solliciter le conseil d’un expert indépendant. L’ensemble des contenus de ce site web est fourni uniquement à des fins d’information et ne constitue nullement une offre ou une recommandation d’achat ou de vente de produits ou services financiers quelconques, ni une promesse d’entreprendre ou de solliciter une activité, et ne saurait être considéré comme fiable en relation avec une offre ou une vente quelconque de produits ou services financiers. Les informations figurant sur ce site sont protégées par le droit d’auteur et tous les droits sont réservés. Elles ne peuvent être ni reproduites, ni copiées, ni redistribuées en totalité ou en partie. En cliquant sur « Continuer », vous confirmez à MIMCO Capital que vous accédez à ce site en qualité d'investisseur professionnel disposant des connaissances et des compétences nécessaires pour évaluer les risques associés aux investissements dans des produits financiers, de même, vous confirmez que votre utilisation de ce site ne viole aucune loi ou réglementation applicable.

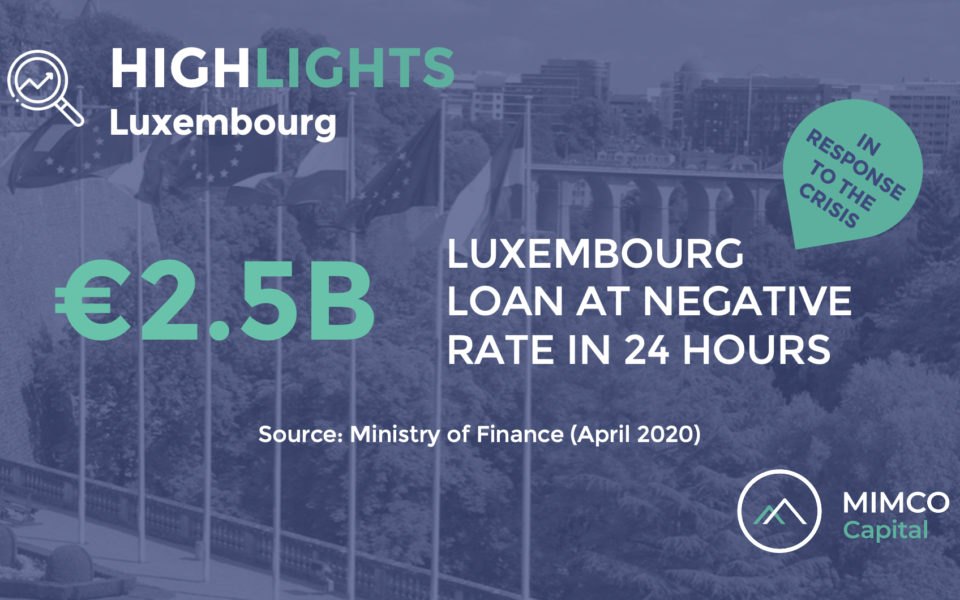

In order to overcome the unprecedented crisis linked to COVID-19 and to support the national economy in securing state loans guaranteed by 7 banks in the Luxembourg financial center in favor of companies, the Luxembourg State managed to close a 2.5 billion euros loan at a negative rate within 24 hours, thus benefiting its treasury.

The country's institutional investors contributed a quarter of the total amount. The other shares were subscribed mainly by renowned investors from the euro zone, the United Kingdom and Switzerland.

The loan is made up of two parts, which is a first for Luxembourg. The first part, with a volume of EUR 1.5 billion, has a maturity of 5 years and the second one, with a volume of EUR 1 billion, has a maturity of 10 years.

The average weighted rate of the two parts is -0.035%, which means that the operation resulted in a surplus to the benefit of the State Treasury. Despite the unprecedented situation, this means that Luxembourg continues to benefit from excellent financial conditions thanks to its "AAA" rating from the main international financial rating agencies.

The Ministry of Finance emphasizes that the operation has received very positive reactions and has been largely oversubscribed. As a result, it was quickly closed. BCEE, BIL, BGL BNP Paribas, Société Générale and Deutsche Bank contributed to the transaction as lead managers. The loan will be listed on the Luxembourg Stock Exchange.

"The success of this loan will enable the State to strengthen its liquidity cushion, while ensuring the implementation of the measures of the economic stabilization program to deal with the COVID-19 crisis. Both the large excess demand and the negative interest rate are a sign of investor confidence in Luxembourg, one of the few countries with a "AAA" rating, and in its ability to overcome the current crisis in a sustainable manner", said Pierre Gramegna, Minister of Finance.

The operation does not involve any risk for the country's public finances. Before the crisis, public debt only reached 20% of GDP. This loan should bring it down to between 23% and 25%, which is still far from the maximum of 60% imposed by the European Union's Stability and Growth Pact.

Sources:

Press release from the Ministry of Finance on 22.04.2020

Paperjam: "Luxembourg got 2.5 billion in 24 hours", 22.04.2020

Corporate

MIMCO has acquired a minority stake in the five‑star Maison Barrière Vendôme hotel, through the structuring of a preferred equity investment on behalf of a private family. MIMCO will also be responsible for asset management.

Announcement

The MIMCO Group is pleased to announce the signing with Radisson Hotel Group for the operation of a 4‑star hotel within "The Butler" project, located in Bertrange, just steps away from Luxembourg City center.

Announcement

The pan‑European asset management group MIMCO publishes a new white paper dedicated to Serviced Apartments and Branded Residences, two rapidly growing segments within the European hospitality market.

Announcement